- 2021-04-18 发布 |

- 37.5 KB |

- 11页

申明敬告: 本站不保证该用户上传的文档完整性,不预览、不比对内容而直接下载产生的反悔问题本站不予受理。

文档介绍

《财务报告分析》教学大纲

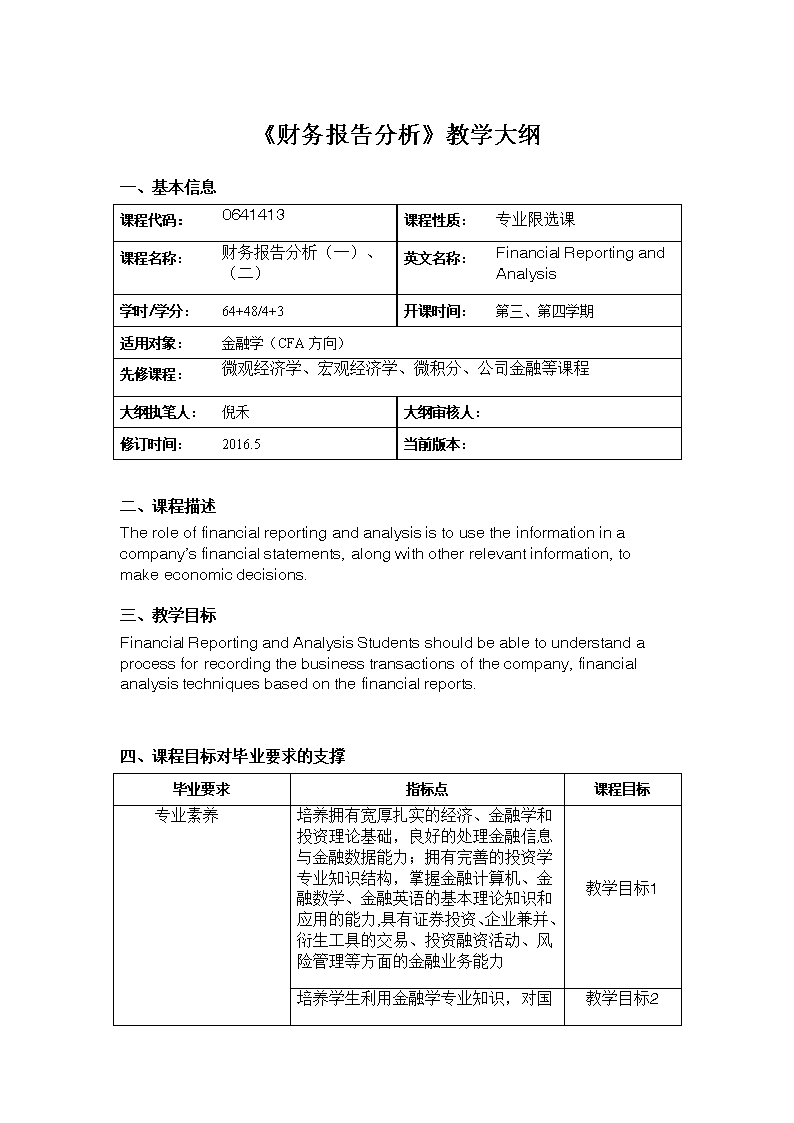

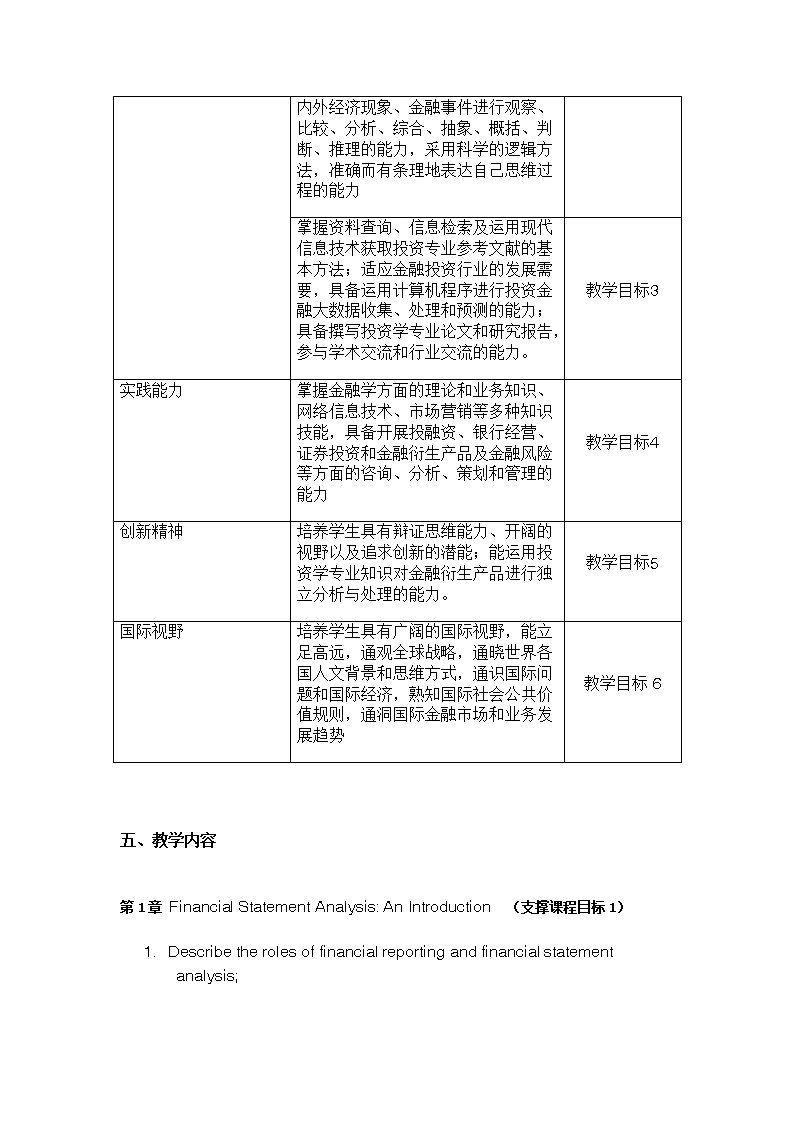

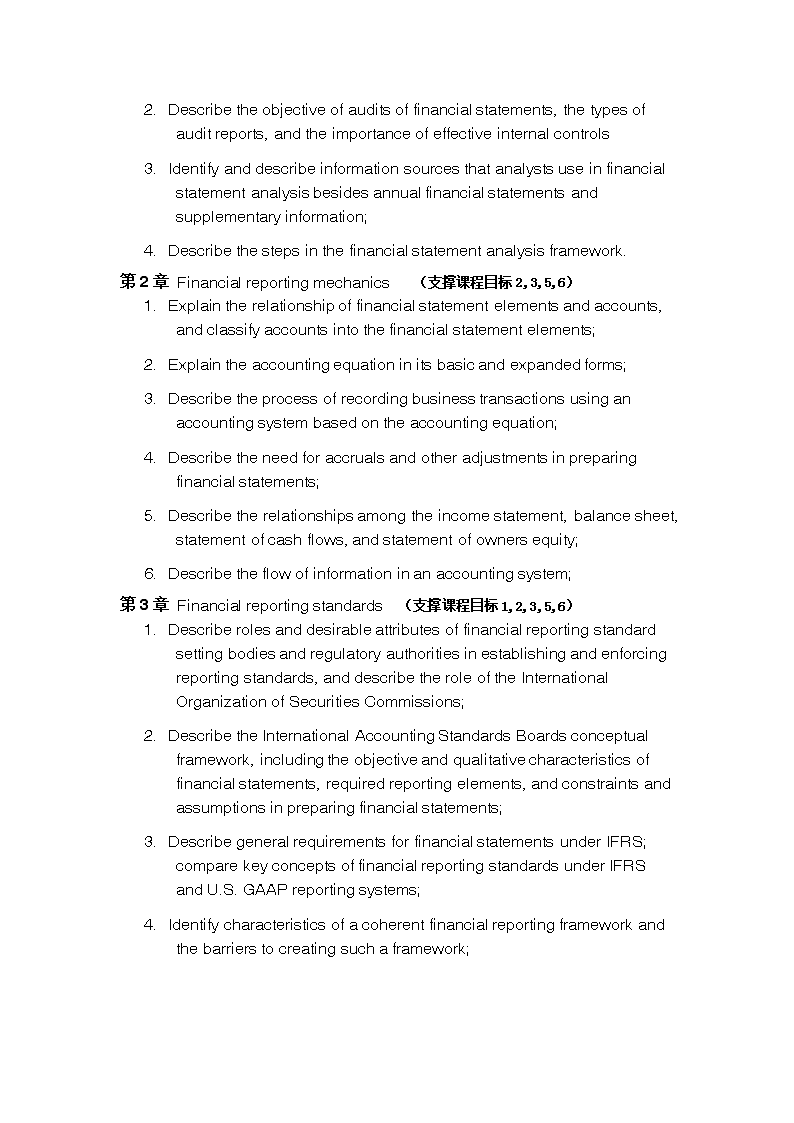

《财务报告分析》教学大纲 一、基本信息 课程代码: 0641413 课程性质: 专业限选课 课程名称: 财务报告分析(一)、(二) 英文名称: Financial Reporting and Analysis 学时/学分: 64+48/4+3 开课时间: 第三、第四学期 适用对象: 金融学(CFA方向) 先修课程: 微观经济学、宏观经济学、微积分、公司金融等课程 大纲执笔人: 倪禾 大纲审核人: 修订时间: 2016.5 当前版本: 二、课程描述 The role of financial reporting and analysis is to use the information in a company’s financial statements, along with other relevant information, to make economic decisions. 三、教学目标 Financial Reporting and Analysis Students should be able to understand a process for recording the business transactions of the company, financial analysis techniques based on the financial reports. 四、课程目标对毕业要求的支撑 毕业要求 指标点 课程目标 专业素养 培养拥有宽厚扎实的经济、金融学和投资理论基础,良好的处理金融信息与金融数据能力;拥有完善的投资学专业知识结构,掌握金融计算机、金融数学、金融英语的基本理论知识和应用的能力,具有证券投资、企业兼并、衍生工具的交易、投资融资活动、风险管理等方面的金融业务能力 教学目标1 培养学生利用金融学专业知识,对国 教学目标2 内外经济现象、金融事件进行观察、比较、分析、综合、抽象、概括、判断、推理的能力,采用科学的逻辑方法,准确而有条理地表达自己思维过程的能力 掌握资料查询、信息检索及运用现代信息技术获取投资专业参考文献的基本方法;适应金融投资行业的发展需要,具备运用计算机程序进行投资金融大数据收集、处理和预测的能力;具备撰写投资学专业论文和研究报告,参与学术交流和行业交流的能力。 教学目标3 实践能力 掌握金融学方面的理论和业务知识、网络信息技术、市场营销等多种知识技能,具备开展投融资、银行经营、证券投资和金融衍生产品及金融风险等方面的咨询、分析、策划和管理的能力 教学目标4 创新精神 培养学生具有辩证思维能力、开阔的视野以及追求创新的潜能;能运用投资学专业知识对金融衍生产品进行独立分析与处理的能力。 教学目标5 国际视野 培养学生具有广阔的国际视野,能立足高远,通观全球战略,通晓世界各国人文背景和思维方式,通识国际问题和国际经济,熟知国际社会公共价值规则,通洞国际金融市场和业务发展趋势 教学目标6 五、教学内容 第1章 Financial Statement Analysis: An Introduction (支撑课程目标1) 1. Describe the roles of financial reporting and financial statement analysis; 1. Describe the objective of audits of financial statements, the types of audit reports, and the importance of effective internal controls 2. Identify and describe information sources that analysts use in financial statement analysis besides annual financial statements and supplementary information; 3. Describe the steps in the financial statement analysis framework. 第2章 Financial reporting mechanics (支撑课程目标2,3,5,6) 1. Explain the relationship of financial statement elements and accounts, and classify accounts into the financial statement elements; 2. Explain the accounting equation in its basic and expanded forms; 3. Describe the process of recording business transactions using an accounting system based on the accounting equation; 4. Describe the need for accruals and other adjustments in preparing financial statements; 5. Describe the relationships among the income statement, balance sheet, statement of cash flows, and statement of owners equity; 6. Describe the flow of information in an accounting system; 第3章 Financial reporting standards (支撑课程目标1,2,3,5,6) 1. Describe roles and desirable attributes of financial reporting standard setting bodies and regulatory authorities in establishing and enforcing reporting standards, and describe the role of the International Organization of Securities Commissions; 2. Describe the International Accounting Standards Boards conceptual framework, including the objective and qualitative characteristics of financial statements, required reporting elements, and constraints and assumptions in preparing financial statements; 3. Describe general requirements for financial statements under IFRS; compare key concepts of financial reporting standards under IFRS and U.S. GAAP reporting systems; 4. Identify characteristics of a coherent financial reporting framework and the barriers to creating such a framework; 1. Describe implications for financial analysis of differing financial reporting systems and the importance of monitoring developments in financial reporting standards; 2. Analyze company disclosures of significant accounting policies. 第4章 Understanding income statements (支撑课程目标1,3,5,6) 1. Describe the components of the income statement and alternative presentation formats of that statement; 2. Describe general principles of revenue recognition and accrual accounting, specific revenue recognition applications (including accounting for long-term contracts, installment sales, barter transactions, gross and net reporting of revenue), and implications of revenue recognition principles for financial analysis; 3. Describe general principles of expense recognition, specific expense recognition applications, and implications of expense recognition choices for financial analysis; 4. Describe how earnings per share is calculated and calculate and interpret a company’s earnings per share (both basic and diluted earnings per share) for both simple and complex capital structures; 5. Evaluate a company’s financial performance using common-size income statements and financial ratios based on the income statement; 6. Describe other comprehensive income, and identify major types of items included in it. 第5章 Understanding balance sheets (支撑课程目标1,3,4,6) 1. Describe uses and limitations of the balance sheet in financial analysis; 2. Describe alternative formats of balance sheet presentation; 3. Describe different types of assets and liabilities and the measurement bases of each; 4. Convert balance sheets to common-size balance sheets and interpret common-size balance sheets; 5. Calculate and interpret liquidity and solvency ratios. 第6章Understanding cash flow statements (支撑课程目标1,2,3,4) 1. Compare cash flows from operating, investing, and financing activities and classify cash flow items as relating to one of those three categories given a description of the items; 2. Describe how non-cash investing and financing activities are reported; 3. Contrast cash flow statements prepared under International Financial Reporting Standards (IFRS) and U.S. generally accepted accounting principles (U.S. GAAP); 4. Describe the steps in the preparation of direct and indirect cash flow statements, including how cash flows can be computed using income statement and balance sheet data; 5. Analyze and interpret both reported and common-size cash flow statements; 6. Calculate and interpret free cash flow to the firm, free cash flow to equity, and performance and coverage cash flow ratios. 第7章 Inventories (支撑课程目标2,3,4,5) 1. Distinguish between costs included in inventories and costs recognized as expenses in the period in which they are incurred; 2. Describe different inventory valuation methods (cost formulas); 3. Calculate cost of sales and ending inventory using different inventory valuation methods and explain the effect of the inventory valuation method choice on gross profit; 4. Calculate and compare cost of sales, gross profit, and ending inventory using perpetual and periodic inventory systems; compare cost of sales, ending inventory, and gross profit using different inventory valuation methods; 5. Calculate and explain how inflation and deflation of inventory costs affect the financial statements and ratios of companies that use different inventory valuation methods; 6. Convert a company’s reported financial statements from LIFO to FIFO for purposes of comparison; 7. Analyze and compare the financial statements and ratios of companies, including those that use different inventory valuation methods; 1. Explain issues that analysts should consider when examining a company’s inventory disclosures and other sources of information. 第8章 Long-lived assets (支撑课程目标2,3,5) 1. Distinguish between costs that are capitalized and costs that are expensed in the period in which they are incurred; 2. Compare the financial reporting of the following types of intangible assets: purchased, internally developed, acquired in a business combination; 3. Describe the different amortization methods for intangible assets with finite lives, the effect of the choice of amortization method on the financial statements, and the effects of assumptions concerning useful life and residual value on amortization expense; 4. Calculate amortization expense; 5. Describe the revaluation model; 6. Explain the impairment of property, plant, and equipment and intangible assets; 7. Explain the derecognition of property, plant, and equipment and intangible assets; 8. Describe the financial statement presentation of and disclosures relating to property, plant, and equipment and intangible assets. 第9章 Income taxes (支撑课程目标2,3,6) 1. Describe the differences between accounting profit and taxable income, and define key terms, including deferred tax assets, deferred tax liabilities, valuation allowance, taxes payable, and income tax expense; 2. Explain how deferred tax liabilities and assets are created and the factors that determine how a company’s deferred tax liabilities and assets should be treated for the purposes of financial analysis; 3. Calculate the tax base of a company’s assets and liabilities; 4. Calculate income tax expense, income taxes payable, deferred tax assets, and deferred tax liabilities, and calculate and interpret the adjustment to the financial statements related to a change in the income tax rate; 1. Evaluate the impact of tax rate changes on a company’s financial statements and ratios; 2. distinguish between temporary and permanent differences in pre- tax accounting in- come and taxable income; 3. Describe the valuation allowance for deferred tax assets, when it is required and what impact it has on financial statements; 4. Analyze disclosures relating to deferred tax items and the effective tax rate reconciliation, and explain how information included in these disclosures affects a company’s financial statements and financial ratios; 5. Identify the key provisions of and differences between income tax accounting under IFRS and U.S. GAAP. 第10章 Non-current (long-term) liabilities (支撑课程目标2,4,5,6) 1. Determine the initial recognition, initial measurement and subsequent measurement of bonds; 2. Describe the effective interest method and calculate interest expense, amortization of bond discounts/premiums, and interest payments; 3. Explain the derecognition of debt; 4. Describe the role of debt covenants in protecting creditors; 5. Describe the financial statement presentation of and disclosures relating to debt. 第11章 Evaluating quality of financial reports (支撑课程目标2,4,5,6) 1. Demonstrate the use of a conceptual framework for assessing the quality of a company’s financial reports; 2. Explain potential problems that affect the quality of financial reports; 3. Describe how to evaluate the quality of a company’s financial reports; 4. Evaluate the quality of a company’s financial reports; 5. Describe the concept of sustainable (persistent) earnings. 六、教学安排 该课程累计共64+48=112学时为课堂授课教学时间。实验实践单独设课,同时开设开放实验。建议教学进度如下: 章节 学时数 Financial Statement Analysis: An Introduction 5 Financial reporting mechanics 9 Financial reporting standards 9 Understanding income statements 12 Understanding balance sheets 12 Understanding cash flow statements 13 Inventories 13 Long-lived assets 10 Income taxes 11 Non-current (long-term) liabilities 9 Evaluating quality of financial reports 9 七、课内实验内容、要求及学时 1. It is our shared responsibility to develop and maintain a positive learning environment for everyone. Please consult the list of behaviors that promote a positive learning environment. l Be on time and stay until class ends; l Participate with others, do not dominate; l Be an active listener and ask questions; l Keep an open mind; l Come to class adequately prepared; bring all relevant materials to class; l Turn off cell phones; do not do non-class activities; l Do not talk when your instructor is lecturing or another student is presenting; l Treat others with respect. No form of prejudice will be tolerated. Failure to behave in a professional, courteous manner will result in penalties. 1. It is your responsibility to do the learning by completing the readings, by attending class and by participating in class discussions and assessment exercises. 2. Assessments such as tests and final exam will be used to determine how successful you are at achieving the course learning outcomes outlined in the syllabus. If you find you are not mastering the material and skills, you are encouraged to reflect on how you study and prepare for each class. I welcome a dialogue on what you discover and may be able to assist you in finding resources on campus that will improve your performance. 3. All work for credit must be legible and submitted by the due date. Points will be deducted for errors in spelling and grammar. You will not be allowed to take the test/exam if you are 5 or more minutes late. Unless an exception has been made by me in writing, late work will receive ZERO credit. Disputes of graded work will NOT be considered after a week from the date grades are posted. 4. Your own illness will be allowed as an excused absence; however a doctor’s note will be required. Major family emergencies such as a death or a major illness will also be accepted as an excused absence; however documentation will be required. If you have an excused absence, you should let me know within a week of the absence. Otherwise, you will receive ZERO credit for missed credit. There will be NO exception. NO make-up test/exam will be given. 1. 1. It is our shared responsibility to develop and maintain a positive learning environment for everyone. I take this responsibility very seriously and will ask you to leave the classroom if your behavior makes it difficult to carry out this task. As a fellow learner, you are asked to respect the learning needs of your classmates and assist me achieve this critical goal. Please consult the list of behaviors that promote a positive learning environment. 2. You are encouraged to study together and to teach each other. However, it is unethical and unprofessional to present the work done by others in a manner that indicates that you presenting the material as your original ideas or work. Tests will cover the lectures and assigned activities. Use of any communication devices during a test will be considered academic misconduct. All electronic communication devices must be turned off while in the classroom. There will be no sharing of materials. Cheating, assisting others, or plagiarizing on tests will result in a grade of ZERO on the test for the student(s) involved; or a grade of F for the course, at my discretion and based on the seriousness of the situation. 3. In this class, students may not make audio or video recordings of course activity. All students who record and/or distribute audio or video recordings of class activity are subject to discipline pertaining to student conduct matters. 八、教学方法与手段 1. Exam questions will resemble problem set questions. Please seek out practice problems wherever you can. Look beyond the assigned problem sets! Many textbooks have extra exercises. The internet is another resource. The teaching fellow, course assistants, and I are more than happy to help you solve/learn relevant material that you encounter independently. 2. Read the assigned readings before lecture and again after lecture. 3. If pressed for time, you are better off practicing problem solving rather than memorizing the details of an assigned text. 1. Please feel welcome to ask questions in class. Illuminating digressions are exciting. However, I may defer your question to a later date or to office hours if it will get us too far off track. 九、考核方式及成绩评定 考核方式: 闭卷考试 成绩评定标准: 平时30%,其中课内作业10%,课后作业20%;考试70% 十、教材及主要参考书 指定教材: [1] Gerald I. White, Ashwinpaul C. Sondhi (2002) The analysis and use of financial statements, 3rd Edition, John Wiley. [2] Pamela Peterson Drake, Frank J. Fabozzi (2012) Analysis of Financial Statements, 3rd Edition, Wiley. 查看更多